For 30 years there has been a divergent view as to the best approach to using technology to support the key finance process of consolidation and reporting, generally known today as the “record to report process”.

To deliver excellence in the record to report process SAP now offers S/4HANA Group Reporting. Read on to see if it's the best technology for you:

The divergent views could be split into two clear camps:

- ERP Integration: Consolidation is best integrated into the underlying transaction processing systems as the fundamental requirement is the aggregation of trial balances from multiple companies, with the application of relevant accounting adjustments to eliminate the investment in subsidiaries, minority interests etc. This approach was incorporated many years ago by SAP into its core ERP solution and was known as “EC-CS” or Enterprise Controlling – Consolidation System. A key dependency of this approach for real success, however, was that these multiple companies were all on the same shared accounting system with a common chart of accounts. As soon as there were companies in the group not on the common platform then additional effort was needed to integrate and map data from disparate systems with different charts of account into the common ECCS platform.

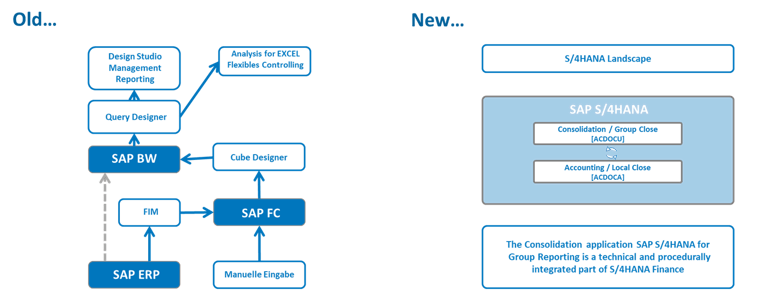

- Best of Breed Consolidation: Very few large international groups have all their companies on one accounting platform and consolidation has many requirements above and beyond the aggregation of trial balances from multiple companies and the application of accounting rules if the process is to be truly efficient. For example, there are large quantities of non-financial data to be collected and consolidated as well as a clear need for movements as well as balances to be included in the process to automate the disclosure notes required under IFRS and US GAAP. Therefore, the better approach was to use a specialist consolidation solution that had specialist functionality, and which could also be integrated with multiple underlying accounting systems and charts of account. Traditionally these options were developed and sold by the specialist vendors such as Hyperion, Cognos, Camshare, Cartesis and Outlooksoft. Through acquisitions, of course, SAP also became a supplier of two such solutions, Cartesis Magnitude became SAP Financial Consolidation (SAP FC) and Outlooksoft became SAP Business Planning and Consolidation (SAP BPC).

During the last 30 years there has been no clear winner in this discussion and the divergent views have persisted, even to the extend that a major vendor like SAP offered, and still does, both approaches in their portfolio of products. Indeed, one might argue both approaches can be very successful and the key to success is the maturity and extent of homogenous use of a single ERP platform in any corporate group. Indeed, look at those organisations who excel at the speed of financial close, and you will find both alternative approaches in common use.

Record To Report SAP | New Generation

With new generation cloud based ERP and accounting solutions becoming widely used and more prevalent it is becoming easier to move corporates to a common accounting platform and so, it is not a surprise, that SAP have developed a new generation consolidation solution as a component of their S/4HANA Finance solution in the Cloud, known as S/4HANA Group Reporting and this blog seeks to review this new solution to see if it will close the gap on the two divergent views of the best solution to deliver excellence in the record to report process. [Note that although a cloud developed solution S/4HANA Group Reporting is also available as an on-premise solution].

Record To Report SAP | The underlying strategy for SAP S/4HANA

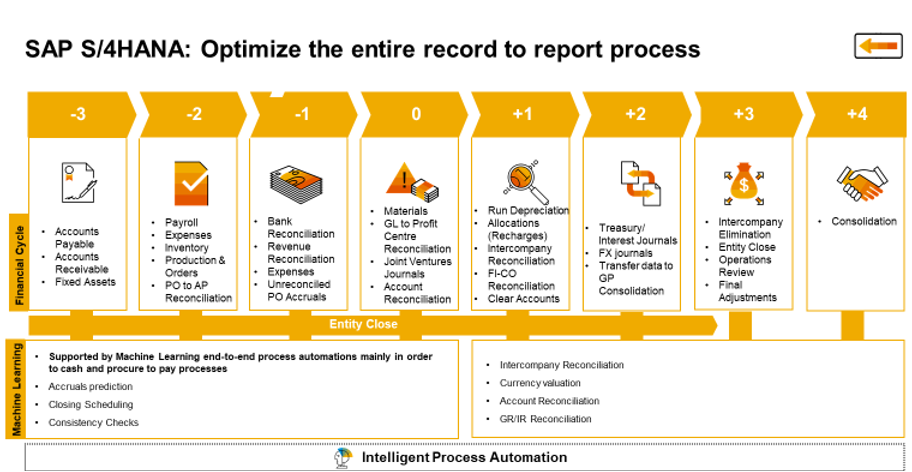

SAP has invested heavily in creating its S/4HANA strategy and associated solutions and it is designed to deliver new capabilities to the enterprise as well as promoting process efficiency and automation, all built on new cloud technologies around the HANA in memory core solution. The key new capabilities delivered include real-time processing of data, combining transactions and analytics using single sources of data stored in HANA and a much-simplified data model that supports this integration and automation, known as the “Universal Journal”. These are exciting and innovative new capabilities which promise much for the finance function and when used to support the record to report process have the potential to deal with some of the key challenges still faced by organisations today in delivering full record to report efficiency. How SAP exploits S/4HANA across the cycle is well summarized in the diagram below:

Beyond the gains of such an approach for transaction recording and sub-ledger processing, from a consolidation process point of view the key win with this strategy and model is the integration of transactions and local accounting with the consolidated view and the elimination of the need to move data from a trial balance and transactional view into a separate repository to hold the corporate and consolidated view, a necessity when the best of breed consolidation approach is taken and which inevitably can cause process inefficiencies.

You can see how this integration and single source of data could significantly improve the reconciliation processes between sub-ledgers and general/nominal ledger and facilitate the elimination of issues with inter-company reconciliation and reporting which still rank as one of the most common pain points in the record to report process along with data validation and integration, also largely eliminated by the SAP S/4HANA Finance strategy. But this approach is still dependent for its success on the adoption of a single ERP solution across the corporate organisation or the provision of tools that help close the functionality gap between a best of breed approach and the ERP integration approach to Group Reporting. So, a key question to consider is what the S/4HANA for Group Reporting solution does to address the challenges of ERP harmonisation and bring into its capabilities the attractive features found in best of breed solutions.

Record To Report SAP | The pedigree of SAP S/4HANA Group Reporting

As mentioned earlier, SAP has had in its portfolio of solutions, for over 10 years, products that adopt the best of breed approach and the ERP integration approach and talking to the solutions owners for S/4HANA Group Reporting it is clear they are intending to include in the functionality for the new solution the very best of what is offered in their BPC and FC consolidation solutions.

For those familiar with these solutions the key features which distinguish them include flexibility of account and dimension design, rules based eliminations, a principle of holding and processing flows or movements for all financial accounts, flexible data collection including unstructured data, non-financial data and commentary, extensive data validation and process flows and process monitoring, integration with disclosure management tools, top-side journals and adjustments, extensive configurable audit trail, manual data entry to supplement integration and data mapping from source systems, integration and budget and forecast data for consolidation completing the analytical repository for group level analysis and reporting etc.

The latest releases of SAP S/4HANA for Group Reporting are already beginning to include many of these features and this is already closing the functional gap between the two divergent approaches while the strength of working with only one set of transaction and consolidated data is already self-evident in the solution.

Some of the key features already delivered as part of S/4HANA Group Reporting

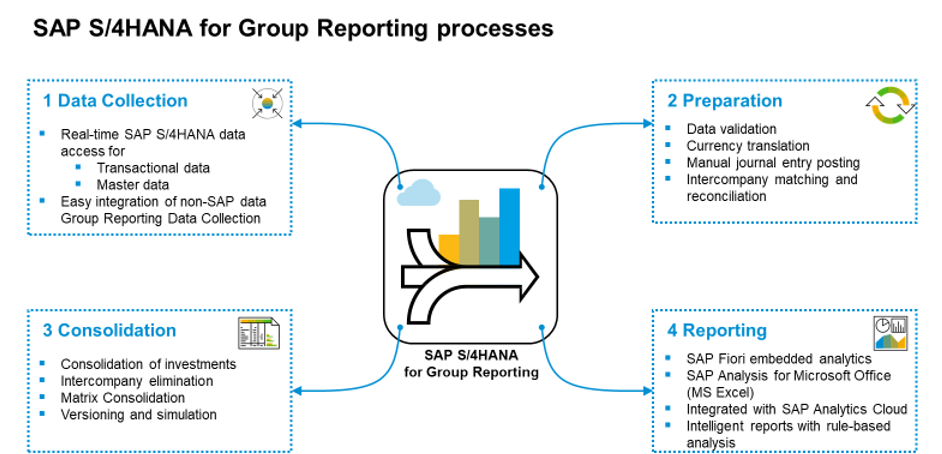

S/4HANA Group Reporting is already feature rich in several key areas and early deployments are illustrating the value of this functionality. The functionality is designed to assist with all the key stages of the consolidation process, data collection, data preparation, the consolidation process itself and reporting and analysis:

So, lets look at some of the key functionality delivered to date:

Embedded analytics: with S/4HANA Group Reporting fully exploiting the universal journal and the single source of transactional data, analytics and drill through become much simpler and more powerful than they have been before both in the ERP integration or Best of Breed approaches. Drill down is delivered from consolidated data item, to entity, to journal, to single balance and to transactions without any additional complex integration requirement. Indeed, data can be sliced, diced and drilled into across any dimensions within the Universal Journal data model;

Multiple options for reporting: Integrated with the S/4HANA Group Reporting solution without any additional configuration work are the SAP Analysis for Microsoft Office (AfO) solution and the SAP Analytics Cloud solutions. These tools bring rich functionality for reporting through Excel which is a must for everyone who works in the Group Finance function as well as advanced analytical capability through SAC, also a new SAP option which is integrating visual analytics and powerful predictive and planning capabilities in one tool. The power of both is again the integration with the S/4HANA Platform and the Universal Journal such that neither reporting tool needs to create its own data repositories and both are able to source master data and data from the one single source, including the ability to drill through from top consolidated balance to lowest level of transaction;

Data Collection: For data being sourced from S4/HANA Finance there are powerful controls around when data is released and available for consolidation within the Universal Journal which can be configured to suit corporate processes. Alongside this, the approach between S/4HANA Finance users at the local and Group level is consistent with a shared user interface, shared applications and data integration around the universal journal and accounting journals. Finally, and importantly from a traditional best of breed solution point of view, there is a growing collection of functionality to integrate data from non-SAP S/4HANA ERP’s and other sources including a functionally rich mapping engine, manual input to reports, and the collection of non-financial data through manual input to custom forms, if there is no system to source and map data from.

Inter-company data reconciliation: S/4HANA Finance and Group Reporting tackles the traditional group pain point of inter-company reconciliation very effectively. Firstly, for those entities on S/4HANA Finance transactional level matching is real time and immediate with transactions recorded against both counterparties and immediately reconciled with appropriate matching spot rates for multicurrency transactions. This means when it comes to the Group process of inter company reconciliation problems should already be resolved but even so matching and reconciliation rules can be configured by finance users without IT involvement and the reconciliation and elimination process is fully automated. For example, reconciliation is down to transaction level, not the traditional balance level, text comments can be added for an approver to explain a difference and why it should be written off on consolidation and automation of elimination of discrepancies within specific tolerances. Finally, to enable consolidation across matrix organisations (for example legal view against management view) inter-company eliminations can be performed across consolidation entities, segment and profit centre.

Consolidation methods: Building on the sophistication of the approach to inter-company processing and elimination, the functionality within S/4HANA for Group Reporting is also extensive to enable the integration of financial and management consolidation with the one source of data from the Universal Journal. For example, when classifying entities legal group structures and non-controlling interest calculations are kept separate from management reporting hierarchies and for matrix consolidations there is one step configuration for the alternative roll-up’s necessary with postings being made as appropriate to create the correct eliminations across the alternative hierarchies. This functionality is also matched with the time dependent organisation hierarchy functionality so that as group components change the matrix views are also updated accordingly for all the accounting elimination calculations.

S/4HANA Group Reporting Implementation Experience – The story so far

S/4HANA for Group Reporting is a fast maturing solution and it has already been successfully implemented by several organisations across the globe. Those implementing it are seeking to “close the gap” not only between the functionality of a best of breed solution and the ERP Integration approach but also between the traditional need for a separate data repository for Group Reporting data and the data created by transactions which sit in the transaction processing system.

A few things though are very clear about the successful projects which have migrate from the old model to the new model of Group Reporting and Consolidation.

It is not a tool replacement, just swapping out SAP FC, SAP BPC or Oracle HFM or any other solution for S/4HANA Group Reporting. The projects are part of larger finance transformation programs where S/4HANA Finance is replacing the traditional ERP solutions and so S/4HANA Group Reporting is an attractive component of that overall transformation, particularly when the business case for that transformation demands a move to fast close or even a daily close. Amongst the early adopters of the solution are those who have traditionally used SAP EC-CS and SAP BCS as they are already convinced of the ERP integrated strategy and can see how S/4HANA Group Reporting adds significant value alongside the move to S/4HANA Finance.

It is also clear from these early implementations that a holistic approach to the implementation of S/4HANA Finance and Group Reporting is needed. This will help to deliver significant finance process change and efficiency but may need to displace some old ways of working. In designing the to-be processes and supporting S/4HANA solutions it will need a design that reaches across the four key dimensions of content, organisation, process and systems and certain key elements are critical. Amongst these critical items are: uniform master data, uniform booking logic, local accounting able to meet the relevant group accounting standard, a need for integrated process design with central control, clear responsibilities and management structures with central administration of specifications, requirements and master data and finally, integration of IT systems and applications so that there are no broken chains in the to-be design. A tough set of demands but essential to project success.

So, is S/4HANA Group Reporting the must implement solution for Group Reporting in 2021?

There is no doubt that if an organisation is implementing S/4HANA Finance then serious consideration should be given to the implementation of S/4HANA for Group Reporting as part of that project. The functional improvements in Group Reporting are closing the gap between best of breed consolidation solutions and the integrated ERP approach and there are significant improvements in business process to be gained by closing the gap in functionality and in group data and transaction data. However, we would still urge our clients to exhibit caution as it is a relatively new SAP product and there is still much functionality to be delivered and implementation experience to be gained. Though this situation is improving by the month as more implementations go-live.

S/4HANA Group Reporting does also illustrate the commitment SAP are making to its new Finance and Analytics solutions in the Cloud both financially and strategically, it is a clear direction. Even if your existing solution for Group Reporting are serving you well, this new solution is well worth investigation and consideration for your Group Reporting and Finance road map.

One other consideration we have not mentioned so far in this blog is a feature that for some is still very important, using one tool and one skill set to implement an integrated EPM (Enterprise Performance Management) Solution. In other words, one solution that can cover the whole range of business processes for performance management, from consolidation and reporting to financial and strategic planning.

This has been promoted as a unique selling point by many solutions over the years, most notably by SAP with their BPC solution. The SAP strategic direction is creating some divergence in this approach with SAC for Analysis and Planning and S/4HANA Group Reporting for consolidation, but both built around the S/4HANA platform accessing common data and master data. For those who still prefer the single tool for the whole scope option, SAP BPC on HANA still has life and is worthy of consideration, particularly in its latest BPC 11.1 incarnation and close integration with S/4HANA.

How can we help you determine if you are ready for S/4HANA Group Reporting?

We are happy to give you a deeper dive into S/4HANA for Group Reporting functionality and our experience to date with implementation. We can also help you assess the current state of your finance processes and consolidation and planning processes. Such an evaluation can help you determine your short term opportunities for improvement using your existing EPM solutions as well how you might build a business case for finance improvement that could well be supported by an S/4HANA Finance implementation, including Group Reporting and SAC. Our focus and concern will be helping you to understand the SAP road map and how it impacts your current system landscape and the way you should approach your roadmap and upgrade opportunities.

Want to know more? You can watch the recording of our joint SAP and EPM International

Webinar: Re-inventing the Financial Close: SAP Group Reporting Briefing

![]()