You may have noticed in the news recently that many large multinationals have been the subject of some rather intense media  and public scrutiny regarding the amount of tax they pay in certain countries. As media pressure and public anger has escalated, governments and regulators have been compelled to take action to improve the visibility of where companies make their profits and where they pay their taxes to help ensure that they pay a fair share to the coffers of the national governments.

and public scrutiny regarding the amount of tax they pay in certain countries. As media pressure and public anger has escalated, governments and regulators have been compelled to take action to improve the visibility of where companies make their profits and where they pay their taxes to help ensure that they pay a fair share to the coffers of the national governments.

It had become obvious to governments that the underlying issues could not be addressed by unilateral regulation and instead need a cohesive joined up approach to tackle tax base erosion and profit shifting through transfer pricing arrangements between multinational subsidiaries. The OECD in conjunction with the G20 countries devised an action plan which includes the need for greater levels of disclosure from multinational enterprises (MNEs) in relation to the countries where their economic activities occur and amounts of tax they pay in each jurisdiction. This has resulted in the creation of the Country by Country (CbC) reporting standards by the OECD that are being implemented through the local tax governing bodies of all OECD members.

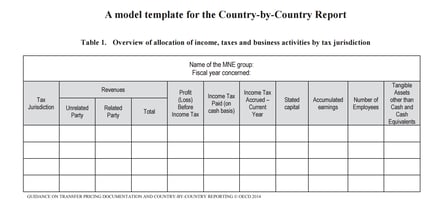

The OECD CbC regime requires the following reporting on a country by country basis;

Aggregate country wide information relating to the global allocation of

* Income;

* Taxes paid;

* and; other indicators of economic activity (stated capital, accumulated earnings, tangible assets, no of employees)

Additionally it requires a listing of all the group member legal entities for which financial information is reported in the country by country report, by country of incorporation, as well as the nature of the principal business activities carried out by each entity. The OECD has even designed the standard reporting template - this is the main form:

(the full template can be reached via the links at the bottom of the page)

The reporting is required to be submitted to the local tax authorities for each country in which they have business activities in the standardised reporting template. The full set of templates and further official guidance can be found through the links at the end of this article.

IMPLEMENTING CBC REPORTING IN A CONSOLIDATION SYSTEM

The good news at the moment is that CbC reporting is to the tax authorities only but significant public pressure in countries such as the UK and France is building and this may yet become a mandatory external reporting requirement – so be prepared!

New regulatory reporting regimes can often be complex and burdensome – think FinRep and CoRep for banks and Solvency for insurers in Europe, or Sarbanes-Oxley in the US! – thankfully the requirements set out by the OECD are a lot less weighty and for most companies the data required for the reporting will already reside in their group consolidation system.

Nevertheless, making sure you can source the required data from your ERP systems and devising a solution to automate the transfer of consolidation data into the reporting templates and reconcile it to the published group accounts with minimal manual effort should be a top priority for the CFO office in 2016 to ensure timely and accurate reporting to the local authorities. In the UK the new reporting standards become effective for MNEs with financial years ending in 2016.

In addition to ensuring your company is ‘CbC ready’ for the official reporting requirements, it may be a good idea to take the opportunity for setting some additional internal management reporting to keep on top of the new disclosure requirements. By doing so you can ensure management can take appropriate action, if necessary, to ensure the reputation of the company remains intact after disclosure. It may be wise to further enhance the collection of tax related payments by country across the organisation in the monthly and/or quarterly reporting packs so that you know exactly what you pay in tax, by type and by country.

Related Content: Column5's Disclosure Management Resources

Column5 can help you interpret the OECD requirements and how best to implement them in your reporting and consolidation environment and has already helped multinationals to achieve this. Furthermore, rather than just respond to the new reporting regime we can help you create value out the requirements by further enhancing your internal tax reporting to help management stay one step ahead of the game.

You can view full details on the Country by Country reporting on the OECD website.

HMRC website regarding implementation in the UK, click here.

More Content for You:

Blog Post: The Process is King

Blog Post: Spreadsheets to BPC/EPM - A Quantum Leap

Blog Post: The Changing Role of Finance: Results Reporting to Business Partner

Blog Post: SAP BPC Reporting Tips and Tricks

Webcast: EPM Add-in: Tips, Tricks and Reporting & Analysis Best Practices

Author Bio:

Author Bio:

Ciaron Kulczycki is a Senior Consultant on the UK team. He has been with the company for 2 years and has worked on large consolidation implementations. He has over 10 years in the industry.

Ciaron Kulczycki, Senior Consultant, UK Team