It is said that there is no accounting for taste. Meaning, there is no mathematical formula that can define and score what individuals prefer. This is because each person has their own “taste” or set of subjective preferences they find appealing, and attempting to distill this highly variable process of selecting what one finds attractive, tasteful, even beautiful to a digital formula for universal criteria is considered impossible.

For some reason, this same subjectivity has reigned in the world of Enterprise Performance Management (EPM) solutions for too long, as I will argue. With the advent of xP&A (Extended Planning & Analysis), which can be thought of as high-intensity EPM, deciding which solution to buy is more critical than ever.

How did you go about buying an EPM or xP&A solution?

When choosing a technology solution to implement from the available options in the market, clients typically embark on a series of comparative demos. If not provided by the vendor showing their preferred attributes & comparison points, requirements from the demo are provided by the customer. The requirements are based on their current process, and I would like to see how their current process would be rendered on this shiny new technology. Is this the best idea?

How should one decide when to buy an EPM solution?

The first step is to understand how your organization defines your formula for value. It turns out that at least for EPM/xP&A, there is an empirical formula that may even account for taste to a certain extent.

What formula to apply when it is a good idea to implement an EPM/xP&A solution?

When the following is true, then you should buy the solution:

ROI.new - $🔼 > ROI.status_quo

You may be saying to yourself: “OK, what’s your point, David…when a solution drives more net value than it costs to implement the change (signified by the 🔼)…we should buy it?”

Yes. And you may be surprised to learn that most customers do not check this simple formula before buying a solution. So let’s break this down.

ROI = Business process value (BPV) less Total cost of ownership (TCO)

TCO = Software (i.e., license + hosting+support) cost, plus the labor cost to operate the solution

Business Process Value = value of business performance insight/decision quality, external compliance, alignment, sensitivity to external changes, etc. In other words – how effective is your solution in helping you to run your business.

Let’s expand the value formula:

ROI.new(BPV-TCO) - $🔼 > ROI.Status_quo(BPV-TCO)

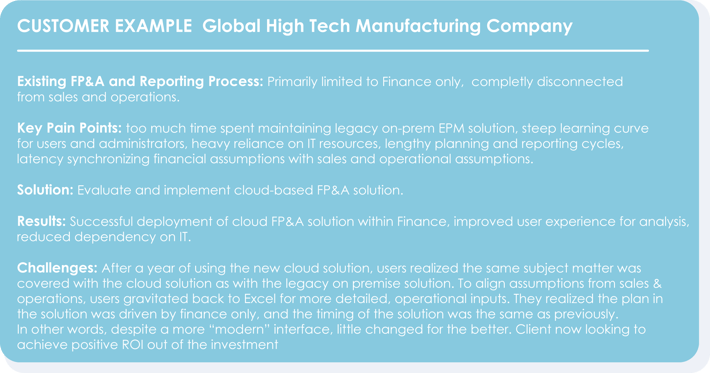

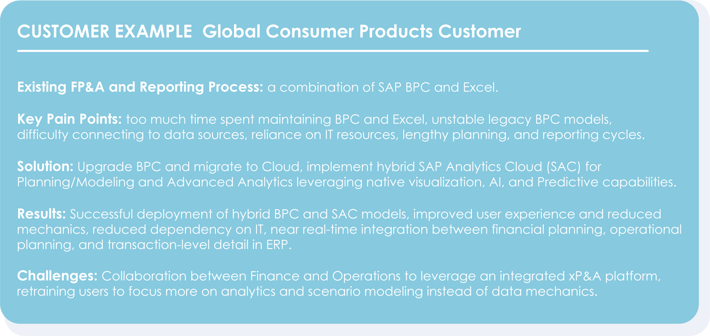

Now let’s stipulate that the quality of their business process is the same before and after implementation for most customers. Meaning, the same income statement, balance sheet, cash flow statement, the same management reporting, and the same statistical measures exist pre and post-implementation. So you might be saying, “wait a minute, of course, our process is better after implementing a new solution!” Not necessarily.

When implementing even basic EPM to automate Excel, many objects remain in Excel post-implementation, and only a select few are deemed worth automating using the EPM solution. Sure, the few automated objects experience efficiency gains as they are prepared faster and perhaps more accurately. However, I argue that those are really gained in TCO. Furthermore, when you apply the same logic to xP&A solutions, the value is even easier to constrain.

In many cases, the new system does not contain all the old system's data; the new system doesn't serve all users, etc. But, for this illustration, we will benefit from the doubt and say the new system is equal to the old.

We can then remove the Business Process Value from the equation because the same insights, analytic outputs, and compliance reports have been produced either way.

Our formula then becomes simpler:

TCO.new - $🔼 > TCO.status_quo

When the cost of ownership of the old system is higher than the new TCO plus the cost to change the system…then it is a good idea to adopt the new solution. Hopefully, this is becoming quite a shocking revelation. What this formula says is that most solutions are bought at a lower cost of ownership. What this formula says is that most solutions’ business case boils down to a lower cost of ownership than the status quo.”

You can do two other things to make this formula more appealing for your organization: Select better consultants and/or change your process.

What can better consultants do for you? Consultants are quality modifiers influencing: TCO & BPV. A poor implementation will produce a solution that takes more labor to support, experiences more downtime, and executes cycles slower, which will consume more resources to own. Excessive TCO may also degrade the value of the outputs, like the quality of BPV enabled too. On the other hand, typical consultants focused on technology implementations do not have any process best practices or confidence in process change consulting, which leaves process scope defined by the customer who is an expert in the status quo. Hence the typical success formula suffers from implementing the same process with a new tool. The value of the change is primarily sourced from improved TCO, which is not much, actually.

Our formula becomes:

ROI.new((CPS*BPV) - (CTS*TCO)) - $🔼 > ROI.Status_quo(BPV-TCO)

Where CPS is Consultant Process Skill & CTS is Consultant Technology Skill

A real-world skillset score would yield a premium or a discounted modifier to the respective value formula component. Good numbers to use in this range could be +/- 50%. For example, a highly skilled technology-focused consulting firm (but low skilled process consulting) could support the following:

ROI.new((.5*BPV) - (1.5*TCO)) - $🔼 > ROI.Status_quo(BPV-TCO)

Such a firm might have a 50% efficiency advantage for Cost of Ownership (by implementing a high-performing and stable solution) but may miss opportunities to improve the business process.

It is easy to imagine the reverse being true, or spending almost double the cost of change to hire an excellent process consulting firm AND an excellent technical consulting team…but hiring two separate teams to work on a project carries its own risks!

Are consultants the easy path to a high-value formula? Nope.

The answer is: Business Process Value. (but you knew that!)

Unless you are changing your business process, and often significantly, the value formula won’t work out. In fact, you may be risking a higher TCO. Gartner says most analytics projects fail to return positive value, and perhaps now you can see why it is too easy to fall into this trap.

But how do I implement a better process? The good news is that the EPM market has been relatively static for two decades, and with the advent of xP&A, new definitions for the business processes are at hand. As a result, motivated client organizations can evaluate their current FP&A process against a more comprehensive xP&A set of requirements.

Column5 is at the forefront of this business process definition. We are eager to help customers break free from the confines of their existing business processes to leverage AI – predictive and Machine Learning fully.

As one customer observed recently, “Column5 is the only firm I have heard articulate anything close to a business process!”. You can test your consultants by asking what business process they recommend. If they ask you, “what business process do you want” – be very concerned. If you would like to learn more about our best practices to exploit state-of-the-art xP&A technology – reach out to us today!