At Column5 our mission is to work closely with our clients to achieve excellence in Enterprise Performance Management (EPM). A core business process embraced by EPM is financial consolidation and external regulatory reporting. Every listed company has to perform this process at least once a year and many perform it quarterly if local regulation requires or even monthly (assuming they have integrated their financial and management reporting, one of our key recommended best practices). Check out our webcast series on the topic at the bottom of this blog post!

DNB and Column5 Start Financial Transformation

For Banks, the quarterly and year-end financial consolidation requirements are made even more onerous by additional regulatory disclosure information, such as the FINREP and COREP reporting requirements in Europe which need to be produced in tight timescales. So, it has been an exciting and rewarding journey for Column5 and our EPM International partners (IFB and ValorGest) to work with DNB ASA, one of the largest Financial Services Groups in Scandinavia, to help them dramatically improve their financial reporting and regulatory reporting processes and systems.

DNB decided in 2013 that it needed to transform its financial consolidation and regulatory reporting systems and processes as part of its wider finance transformation and fast close program. The group was growing through acquisition and the volume of information and complexity of disclosures was also growing whilst its existing consolidation system was reaching the end of its life and going out of support.

DNB ASA Decides to Implement a SAP EPM Solution

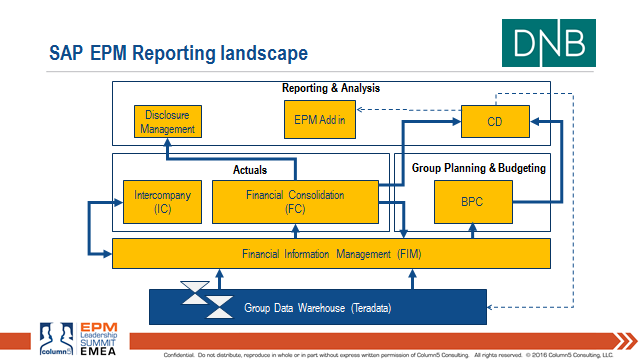

After an extensive evaluation of software options DNB decided to implement a SAP EPM solution that would enable an integrated approach to financial reporting and regulatory reporting. SAP EPM was felt to be the best possible solution for dealing with the large volumes of data and multiple integrated disclosure items, while still enabling achievement of the fast close and efficiency objectives of the wider finance transformation program.

The SAP EPM suite would also provide the tools to manage Disclosure Management and integration with a corporate data warehouse where all the key financial information was being assembled from underlying transactions systems across the group as well as supporting European Banking regulations (COREP and FINREP) in the same solution as IFRS financial statement for quarterly and annual shareholder reporting supporting a fully integrated data model.

We are pleased to say that the mission of implementing these new SAP EPM solutions at DNB has been very successful. The first solution to go-live was the Disclosure Management solution which enabled much better controlled and managed assembly of external reporting information, with a complete audit trail. Since then the integrated financial reporting and regulatory reporting solution has also been fully implemented and has been live since Q3 2015. The end to end solution comprises the SAP EPM components of Financial Information Management (FIM), the peer-to-peer Inter-Company solution, the SAP Financial Consolidation Solution and SAP Disclosure Management.

DNB Wins Reporting Awards Due to their SAP EPM Implementation

The SAP EPM implementation at DNB has been a very successful component of the DNB Finance Transformation program and some recent accolades have confirmed this. In October 2016 DNB won “Farmandprisen”for best Annual Report for Stock Exchange Company Reporting Year End 2015. Farmandprisen is Norway’s most prestigious Annual Reporting prize.

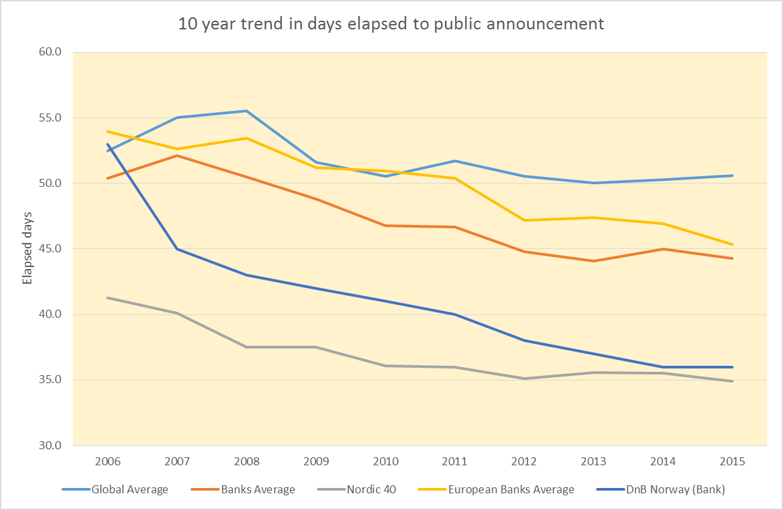

While in September 2016 DNB were awarded an exceptional performance award in the EPM International Close Cycle Rankings awards in 2016 for exceptional performance in reporting timetable reduction. Over the last 10 years DNB has reduced its year end reporting timetable from 54 to 36 elapsed days, a 33% improvement while accommodating significant growth and the new and more demanding regulatory reporting requirements of FINREP and COREP. That successful journey is obvious to see in the graphic above tracking a 10 year cycle of improvement, making DNB one of the leading Financial Service Groups in Europe for speed of reporting.

To find out more about DNB and its succesful journey of financial and regulatory reporting systems and process transformation, we are hosting, with DNB, a series of three webcasts over the coming month, each looking at a sepcific aspect of their overall solution. Each of the webcasts and how to register to attend is set out below. Come and join us and find out why SAP EPM, Column5 and DNB has proved a very succesful combination.

Column5 is proud to present a 3-part webcast series with DNB - Norway's largest financial services group!

- Complex IFRS & Regulatory Consolidation & Reporting in SAP BFC (now available on-demand)

- SAP BFC & Intercompany Reconciliation Best Practices (now available on-demand)

- Disclosure Management (7 December - 10am GMT)

Save your seat for the next upcoming session!

This session will explain how the SAP Disclosure Management solution adds real value to the corporate finance EPM portfolio especially when used with SAP BPC/SAP BFC consolidation tools.

SAP’s Disclosure Management is a solution that facilitates an auditable, compliant workflow that reduces the time, risk and cost associated with the production and approval of both financial and non-financial regulatory statements, disclosures, corresponding XBRL submissions, and other associated output formats.

Author Bio:

David JH Jones leads Column5 in the UK and EMEA. He is responsible for all of Column5’s services in the region, including EPM process design and SAP EPM systems implementation. He also contributes to the global leadership of Column5, particularly as an expert in leading edge EPM processes.

David JH Jones leads Column5 in the UK and EMEA. He is responsible for all of Column5’s services in the region, including EPM process design and SAP EPM systems implementation. He also contributes to the global leadership of Column5, particularly as an expert in leading edge EPM processes.

David is one of Europe’s leading experts in Enterprise Performance Management (EPM) with over 25 years’ experience in EPM, with a particular focus on world class EPM process design as well as system implementation at the Corporate Centre of multinational groups

David Jones, Managing Director of EMEA & UK, Column5 Consulting