SAP BPC is a tool that can be customised to facilitate planning, budgeting and forecasting processes for different

functional areas such as Revenue, Human Capital Management, Operating Expenses, and Capital Expenditure. In this blog we will talk about how to integrate these functional areas into one unified BPC reporting model, for fully integrated planning.

The different functional areas require different data structures and consequently we will need to use a separate BPC model for  each area. To give some common examples:

each area. To give some common examples:

The Revenue model may, depending on the modelling requirements, need to have Product dimensionality in order to plan the sales volumes and calculate planned revenue according to the price by product, and a Customer dimension to plan sales and analyse the outstanding payments by customer or channel.

The Labour planning, or HCM model may need to include a role dimension, in order to plan the salary by role or grade, or an Employee dimension to enable planning by employee or job grade.

The Operating Expenses or OPEX model should enable the user to plan the expense related General Ledger accounts at the required level of detail, for example, by collecting the number of flights and hotel nights and using forecast unit costs to calculate travel expenses.

The Capital Expenditure or CAPEX model should include an asset dimension which will include the company’s asset list and allow the user to plan new asset purchases and the corresponding depreciation for the planning period.

Different forecasting approaches can be applied in each model. A yearly forecast amount which is then allocated across the months may be the best requirement in some models whereas a monthly planned amount may be the requirement for others. The capital expenditure model will have it’s own forecasting logic depending on the life of each asset, the purchase month and the depreciation rules to apply. The actual forecasting method to apply will, of course, depend on the detailed requirements agreed with the client during the blueprinting stage.

Other options are to include strategic and long range models into this solution scope, which may include plans on longer horizons, higher levels of summary, or optimized to model larger decisions like M&A or divestiture activities. Each may have a specialised model to support the needed requirements for the particular scope of the task.

BPC allows us to plan at the appropriate level of detail for each functional area,

BPC allows us to plan at the appropriate level of detail for each functional area,

which has the right level of vision for that area’s managers, using the appropriate forecasting method.

We also need to provide a more global vision of the company situation. Information from the models developed for the functional areas needs to be integrated in a single BPC model which contains data aggregated to the level that the top management will want to see. This model integrates all the financial data, so it is normally called the Finance, or Financial reporting model.

The Finance or Integrated financial data model should include all the dimensions which are common to the other models , which frequently include department, time period, geographical area, planning or budgeting version, data source (to indicate which model the data has come from, or if it is a calculated value). In this model we can derive the balance sheet and cash flow based on input data and drivers such as the debtor days.

BPC can be configured to implement manual or automatic transfers of aggregated data between models, scheduled at certain times of the day, or triggered by events such as data uploads from the source ERP system.

The level of aggregation should be customised to meet the top management reporting needs, generally by general ledger account. Product volumes need not be shown at this level for example, nor salary by employee or operating expense drivers.

Related Content: The Changing Role of Finance: Results Reporting to Business Partner

Data by GL account from the individual functional area models is used to build a fully integrated P&L, Balance Sheet and Cash Flow BPC model which retains the axes of analysis such as department, time period, geographical area and planning or budgeting version, but which does not contain the detail which is specific to each functional area’s planning needs. All of the data is aggregated to the corresponding general ledger account in the Finance model, which means that data by customer, for example, is not transferred from the Revenue model to the Finance model.

The aggregated data in the integrated planning model has not lost this detail however. Drill through functionality can be implemented so that users can click on a number in a cell in a Finance model report and be taken to the functional area model where they can see the calculation used to derive that number. For example, by clicking on the salary General Ledger account number for January the user will be shown a report in the HR model showing how that salary number has been built up by pay scale and headcount for that month.

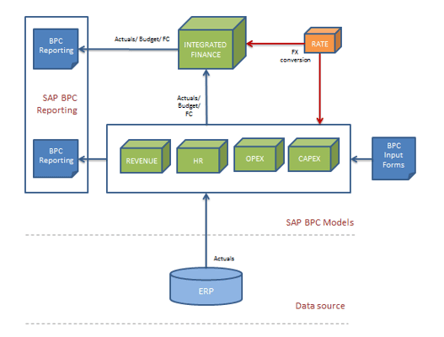

Below you can see a graphic illustration of what a typical integrated planning solution looks like in BPC Standard (BPC Embedded varies slightly in some detail). Actuals data is collected from the source ERP system and plan data is input by users via input form and using the drivers specific to each functional area’s model.

Reporting is done both at functional area model and at Integrated P&L, Balance Sheet and Cash Flow model level.

SAP BPC can develop customised Planning, Budgeting and Forecasting solutions for all functional areas in a business, and integrate that data into a complete P&L and Balance Sheet without losing visibility to, and control of, any of the detailed calculations used to create the plan. It is a truly flexible product!

Please contact Column5 if you would like to discuss in detail how Best Practice planning and forecasting could be designed and implemented for you using SAP BPC 10.1.

Also, we offer SAP BPC 10.1 Reporting Training sessions on a monthly basis!

Here's more articles that may interest you:

Blog Post: Budget and Forecast - Are They the Same?

Blog Post: EPM Hierarchical Planning, Forecasting, and Reporting

Blog Post: Planning and Forecasting: Category Set-Up for SAP BPC

Webcast: Improve Your Sales and Operations Planning With BPC

Author Bio:

Author Bio:

Richard Hynes has been with Column5 Consulting as a Senior Consultant since 2014 and is one of our most popular bloggers, and is also a published author in print with technical books on Microsoft Excel and Database Programming with .NET. He is a trilingual BI professional with a double competency in Finance and IT. Hynes works on the UK team and works with various clients in EMEA.

Richard Hynes, Senior Consultant, UK Team